Data published recently by Pay.UK shows continuing use of the Current Account Switch Service (CASS). As more bank account holders (payers) use CASS to switch their Current Account, more ADDACS reports are generated. These will contain information about ‘Reason Code 3 – Account Transferred to a new PSP (Payment Service Provider – or bank)’. Do your teams know how to respond?

What is the Current Account Switch Service (CASS)?

The Current Account Switch Service (CASS) was launched in 2013. Its aim was to provide a reliable way for account holders to switch current accounts from one bank to another. Account holders who use CASS to switch their current account are protected by the CASS Guarantee. This states that any incoming or outgoing payments will be switched from the old bank account to the new account. Payers will not have to intervene – the bank will manage this.

What is the latest trend with CASS?

Since launch in 2013 the Current Account Switch Service has completed 11.4 million account switches. In 2024 alone, there were 1.2 million account switches. The service has been responsible for redirecting 160.5 million payments – with 99.7% of switches completed within 7 working days.

Research undertaken by Pay.UK in Qtr 4 2004 showed:

- high levels of awareness of the service among consumers – 77% of consumers were aware of CASS.

- high levels of satisfaction amongst users – 91% of CASS users were satisfied with performance.

Given these 2 facts, the numbers using CASS are expected to increase.

Which banks are benefitting from CASS?

Switches took place across 54 participating banks and building societies. Data from July to September 2024, shows that Nationwide had the highest net switching gains. They are followed by Barclays, TSB and Lloyds.

What does Current Account Switching mean for Direct Debits?

When a payer switches their bank account, Service Users will often find about the change through an ADDACS report generated by Bacs.

ADDACS stands for the ‘Advice of Direct Debit Amendments and Cancellations’ report. These reports advise Service Users about changes that affect the underlying Direct Debit Instruction – such as changes to the sortcode or account details.

If a payer uses CASS to change their bank details, the Service User will receive a message on their ADDACS report identified by a ‘Reason Code’. In this case it is ‘Reason Code 3’ – Account Transferred to a new PSP. In this way, current account switching directly impacts the number of ADDCAs messages – so any increases in Current Account Switching – means a greater number of ADDACS reports.

What does the ADDACS Report show?

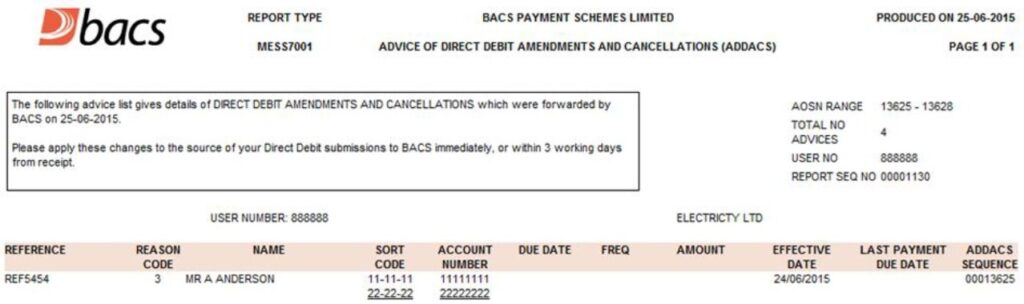

When there is a change due to CASS, the ADDACS report will typically display the old bank details and the new bank details underlined beneath – as illustrated below in an example report.

ADDACS reports are generated when the payer takes an action. Because payers can make these changes at any time, ADDACS reports can be generated at any point.

Under the Bacs Direct Debit Scheme Rules, the correct response to such a message on an ADDACS report would be for the Service User to update the Customer Record in the relevant database e.g. the Customer Relationship Management (CRM) and/or Direct Debit Management System (DDMS).

Bacs advise that Service Users must action their ADDACS reports “immediately or within 3 working days”.

Once the new bank details have been added to the customer record, AUDDIS Service Users should submit a 0N instruction to Bacs for the new bank account. This should be sent within 10 working days. This will lodge the Direct Debit Instruction on the new account. No 0C cancellation should be sent. Non-AUDDIS Service Users should collect with the new bank account details – they do not need to obtain a new DDI.

What other information do ADDACS show?

ADDACS reports can contain other information about amendments to, or cancellations of the Direct Debit Instruction. e.g.

- If a bank holder cancels the Direct Debit Instruction, an ADDACS report will be generated advising the Service User of this fact – with either ‘Reason Code 0’ (cancelled by bank) or ‘Reason Code 1’ – (cancelled by payer). The Service User might then contact the payer – either to invite them to sign-up again or to discuss how any outstanding debts will be settled.

- If a bank account holder reinstates a previously cancelled Direct Debit Instruction, the Service User will be advised of this fact – with a message displaying ‘Reason Code R’ – (instruction re-instated). The Service User should then continue collections.

What is the impact of not actioning ADDACS Reports?

If Service Users do not update their payers bank details and continue to try and collect using old details, they will typically receive notification from Bacs directing them to action their Bacs Reports.

Prompt actioning of ADDACS reports ensures that the database is kept as clean, and up-to-date, as possible. In turn this will result in better success rates of collections and fewer erroneous transactions.

Questions?

If you have any questions about the Current Account Switch Service (CASS) or about the impact on your Direct Debits and ADDACS reports, contact us today. You can read more details about the Pay.UK statistics on their website